If you got into real estate anytime in the last decade, you’ve spent most of your investing life in a market where prices went up, inventory stayed tight, and competition never really let up.

There are some real advantages to that kind of market. Flips, both wholesale and retail, sell fast. Renters are easy to find, and rents usually climb every year. The headlines are upbeat. Everyone feels smart.

It’s fun to be in the real estate business when the wind is always at your back.

The downside of that kind of market is, of course, that everyone wants to be in it. And that means that great deals are hard to come by.

When homeowners and investors are all racing to buy, prices get pushed up and profit margins get squeezed.

Finding deals that actually pencil out as long-term holds or really profitable flips becomes the hardest, most time-consuming part of the business. We find ourselves doing deals that are pretty marginal—because, well, they keep working out as long as the market stays hot, and prices keep going up.

But the one constant in the real estate market is change…and that’s what we saw in 2025.

Buyers hesitated. Inventory grew. Rents and house prices didn’t.

Logically, most of us get that lower sale prices and flatter rents aren’t a problem as long as purchase prices and payment terms come down even more.

Slower sales and less competition = more motivated sellers.

More motivated sellers = lower prices and better terms.

Those are the conditions investors say they want. But ironically, when they finally arrive, fear drives a lot of people to the sidelines.

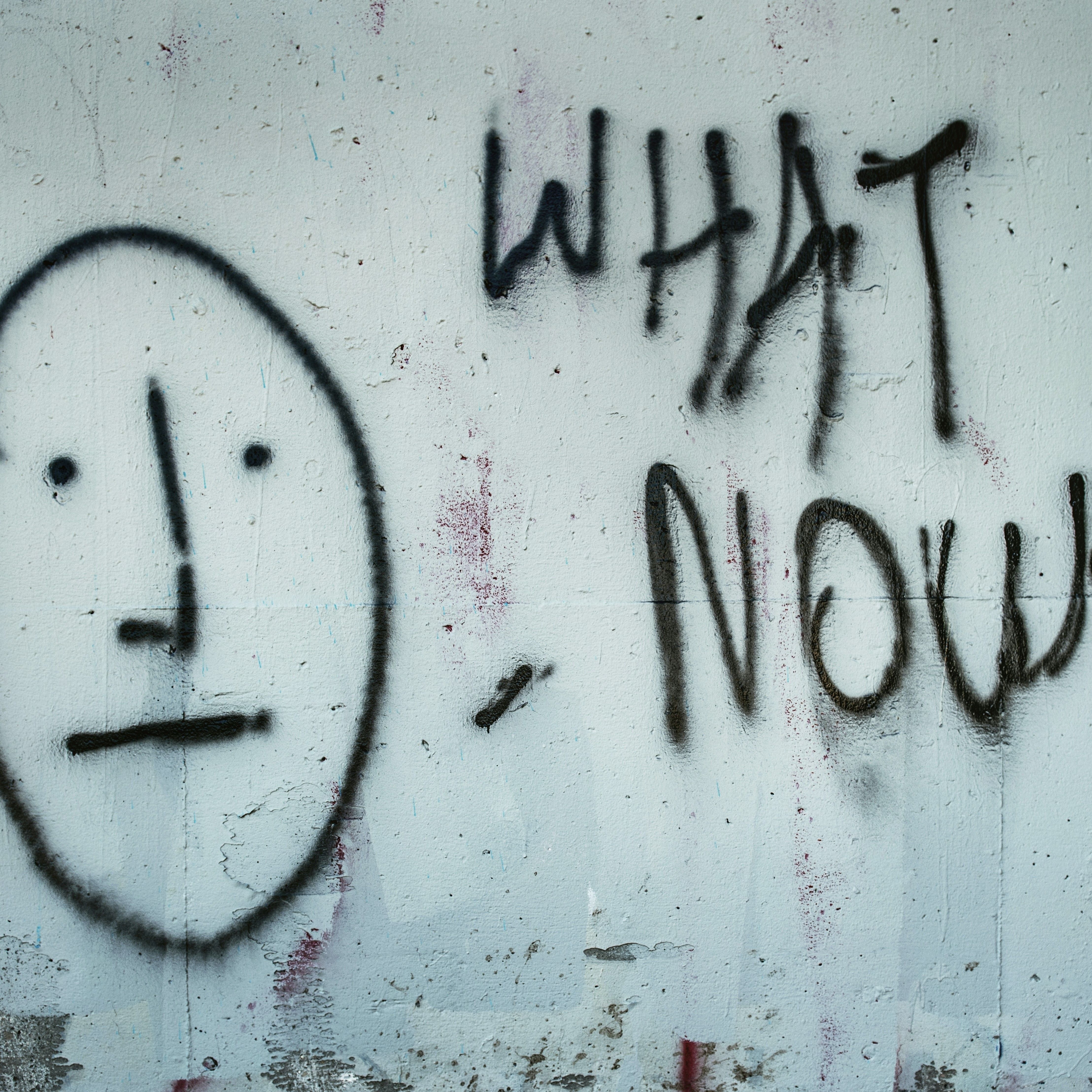

When the market stops being low supply and high demand, we start “What if”-ing our way into a very bad decision—the decision to sit on the sidelines during the very time when some of the best deals of your life could be made.

- What if I buy at a discount and prices drop even further?

- What if I negotiate great seller financing on a rental, and rents soften even more?

- What if I lock up a wholesale deal and there’s no one to buy it?

Those questions are normal. Healthy, even. But they’re also all answerable.

It would be a real shame to miss the opportunities this year will offer simply because you don’t yet have the tools, confidence, or perspective to handle the “what ifs.”

That’s exactly why our focus this year is on education, connection, and practical problem-solving. We’re committed to openly discussing what’s changing, what’s working, and how experienced investors adjust when the market shifts.

No hype. No denial. Just real experts with real strategies, real examples, and real conversations.

Let me say something that living and prospering through 4 of these cycles has taught me: this is not a market to disappear in. It’s a market to get MORE engaged in.

Our job is to be here to help you think clearly, adapt intelligently, and keep moving forward while others step back.

Your job is to Stay connected. Stay learning. Stay around.

This is exactly the kind of market where being part of a strong community makes the difference — and we’re committed to making sure you succeed in it.